Analysis of working capital of a company

In this article, I will cover working capital and how you can make sense of whether the company is efficiently managing it.

Working capital is divided into 3 parts, and it simply means how the company is using its cash to conduct its day-to-day activities. In this article, I will only cover the first part, and the rest will be covered in upcoming articles.

Part 1: Trade receivables

The company makes sales in cash and sometimes on credit. When a company sells on credit, it creates trade receivables (an asset), which means it now has to collect money from the credit sales it made. In the following write-up, I will cover how you can analyze trade receivables.

First of all, compare the growth of sales with the growth of trade receivables. If the company’s sales growth is higher than the growth of trade receivables, it simply means that the company is selling more cash, and if, in any case, the growth in receivables is greater than the growth in sales, it means the company sold more goods on credit, which resulted in higher receivables. You can use visual representations like line graphs to get an idea and also compare it with your company’s peers in the industry.

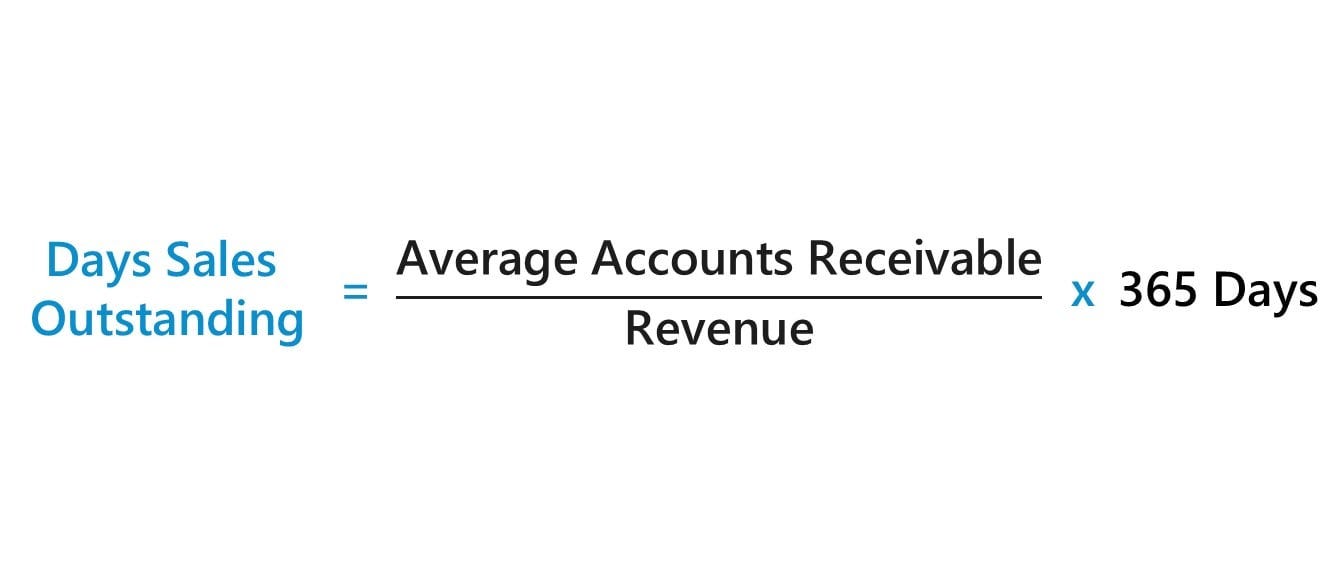

The next step of the analysis is to check how many days the company is able to collect money from its trade receivables, which is also known as trade receivables days or days sales outstanding (DSO). The formula for calculating trade receivable days is:

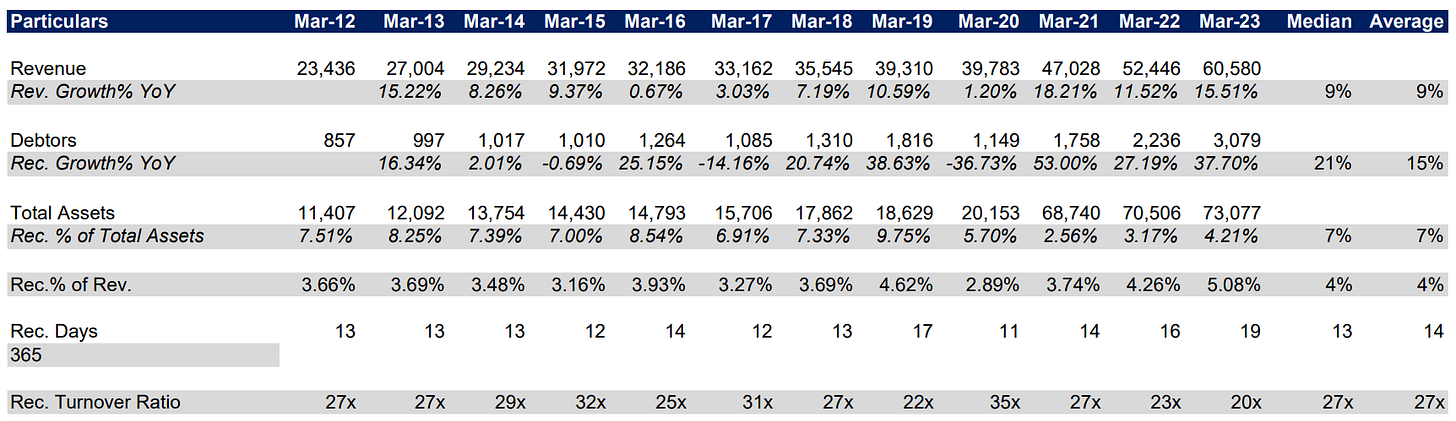

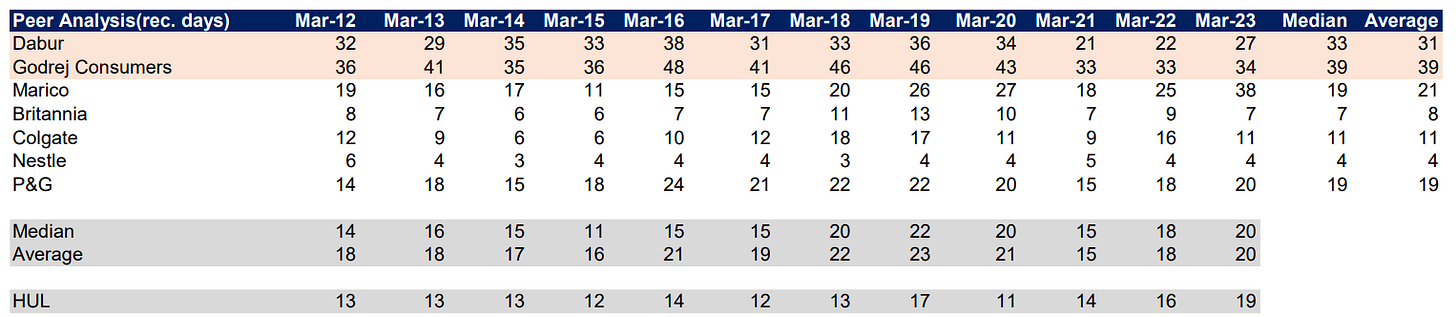

Once you calculate the DSO for the company you are researching, you have to do the same process for the company's peers, calculate the industry median and average DSOs, and also interpret whether your company's DSO is significantly different from the industry's. Also, consider the nature of the industry; for instance, in the dairy industry, trade receivables must be low when compared to the real estate industry because of the perishable nature of milk and milk products and the higher construction time required for building. Below is the data for Hindustan Unilever Ltd.

Once you compare your company's DSOs to the industry's average or median DSOs, they will be either close to or less than the industry's DSOs. In all cases, you have to read what the company's management has to say about trade receivables. This information can be found in the annual reports of the company by searching for credit risk. In this commentary, management talks about the credit quality and aging cycle of the trade receivables, which means that there are chances that the credit sales made by the company will not be recovered. The aging cycle represents the time for which the receivables are outstanding. The next source of data will be the management conference call, from which you can find out what the management says about the receivables. Con-calls can be found on the company's website under Investor Relations. Con calls are not mandatory, so if you can get your hands on the same, well and good; otherwise, move ahead and run some Google searches, and you might get information about the company's receivables.

At last, you have to summarize each part and interpret it.

In this way, you can conduct an effective analysis and get an idea about the trade receivables of the company. In the upcoming articles, I will cover how you can analyze the other two parts of working capital, i.e., inventory days and payables days.